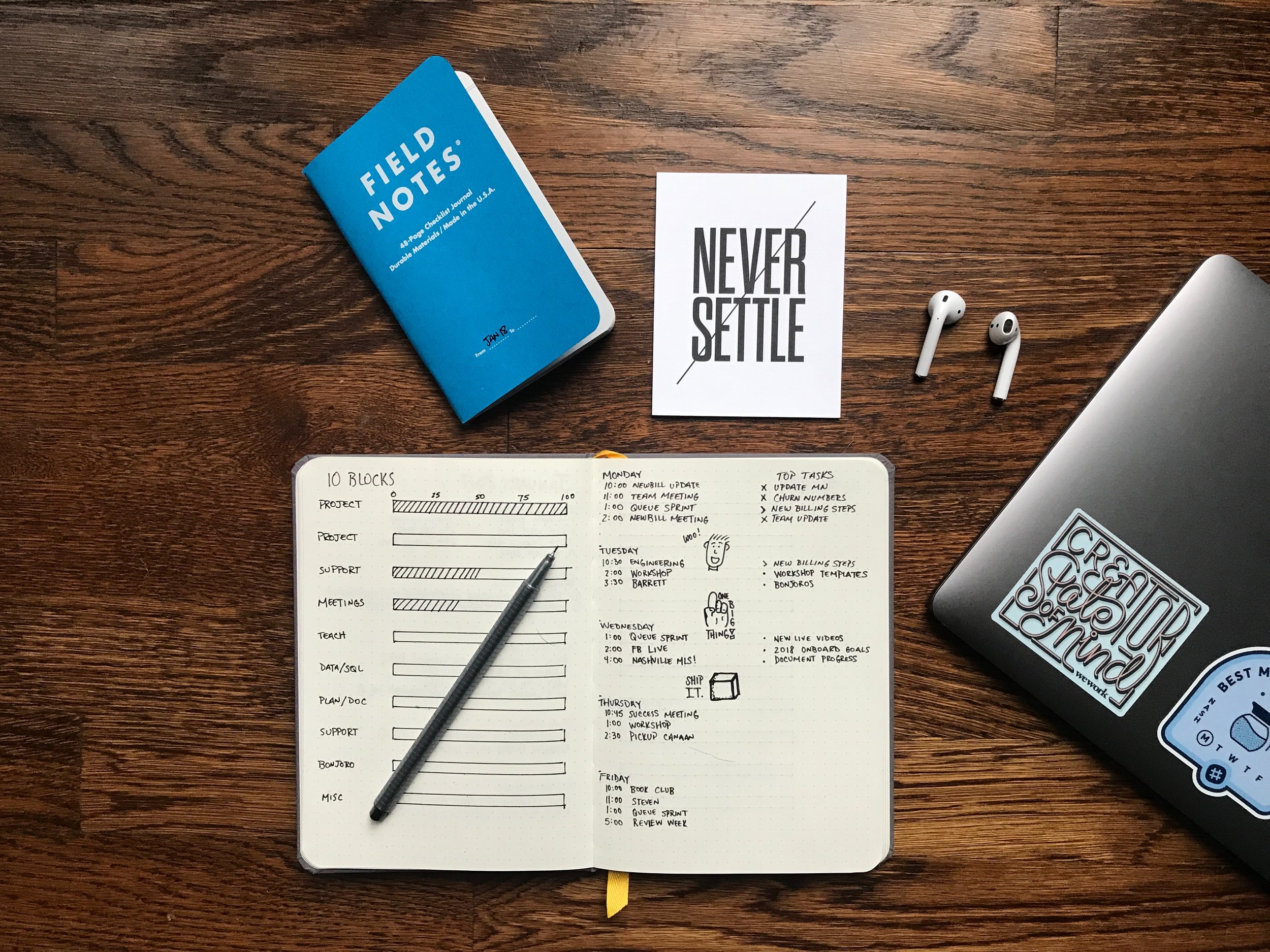

My FP&A productivity approach

Image by Matt Ragland via UnsplashThere are many ways to save time with FP&A tasks.

Here is my approach for each week of a typical month:

📆 Week 1 - Month End-close

You’ll discuss variances between actuals and forecast with your cross-functional business partners. And you may help Accounting make sure that accruals look right.

❌ Don’t: Wait until the last minute with looking at accruals and actuals. There is always a surprise (or two) that makes your life stressful right before the close deadlines. But it doesn’t have to be that way.

✅ Instead: Schedule a check-in with your business partners a week before the close. Yes, you may not yet have final numbers, but there estimates should be close enough at this point. If they aren’t close, then that’s a problem you may be able to coach them on.

❌ Don’t: Explain every line item. In most cases, 80% of the variance between actual and forecast is driven by 20% of the line items. That’s the Pareto principle, also knows as the 80/20 rule.

✅ Instead: Understand not just which line items cause the biggest variance, but also why that is. You need to get an in-depth understanding of the business drivers. That way, you can improve your forecast accuracy and even start to make recommendations about mitigating risks and capitalizing on opportunities.

📆 Week 2 - Management Reporting

Now that the numbers from the previous month are final, you need to communicate the results to senior management or your board of directors. FP&A prepares commentary along with slides or dashboards.

❌ Don’t: Attempt to cram every metric and everything you know on the slides. Not only will that take a long time, it’s also not ideal for those who receive your reports. It essentially says “Here is all the data. Now you go figure out what it means.”

✅ Instead: Focus only on the metrics that tell a story. That means the metric needs to meet two criteria:

It needs to say something about an urgent or important issue. For example, that could be a large deviation to forecast that appears to signal a change in trends.

It needs to be actionable. “Organic sales are down 20%” isn’t actionable. There are too many possible reasons. But if your insight is “Organic sales are down because customer XYZ ordered 300 units less than usual.”, then possible next steps come to mind immediately, for example calling the customer to see if it was just a delay.

📆 Week 3 - Forecast Update

Results are in, the management deck is ready, now you need to figure out what all the new data means for your revenue and expense forecast of the rest of the year.

❌ Don’t: Spend hours and hours on your forecast update. Forecasting is one of those activities that needs to be optimized, not maximized. That’s because more time invested doesn’t necessarily mean better forecast accuracy.

✅ Instead: Use a forecasting method that provides acceptable accuracy with minimal time investment. Consider machine learning based methods (you don’t need to hire a team of data scientists anymore for this, there are great no-code options available now). Or use an approach that has been fine tuned through making small tweaks each month. For example, that could be taking your business partners’ estimate, last years results and creating an average of both, perhaps adjusted for bias.

📆 Week 4 - Financial Modeling

Your business partners are considering making a large investment and asked Finance to approve the budget increase. FP&A has to build a model to determine if the investment is financially viable.

❌ Don’t: Use the most sophisticated Financial model for every investment request. Yes, you may get most accurate results with a Net Present Value model which predicts future cash flows via exponential smoothing and discounts them with the most recent estimate of your weighted average cost of capital. But if your cross-functional business partners reject it because they don’t understand the complex math behind it, then all the hours invested into it were for nothing.

✅ Instead: Consider which model type best fits the business case. For example, if the time horizon is less than one year, you may not need to use a model that discounts future cash flows. A simple Return on Investment analysis may suffice.

If you’d like to learn more about FP&A, I offer help in three ways:

1️⃣ Subscribe to my free newsletter “FP&A Tuesday” here.

2️⃣ Listen to 75 bite-sized mini lessons and get FP&A advice on the go.

3️⃣ Join my live online course FP&A Bootcamp to master FP&A in two weeks.