SaaS sales forecasting strategies

Accurate sales forecasting enables CFOs and finance leaders to predict future revenue, make strategic decisions, readjust strategies, and manage risks. However, for a lot of SaaS businesses, creating sales forecasts is tricky, time-consuming, and often inaccurate. Achieving near-to-accurate sales forecasts hinges on selecting the right forecasting methods best suited to your business's specific needs.

How to get started with FP&A

Getting buy-in can be the trickiest part when your company hasn’t done any real FP&A yet. You must convince your cross-functional business partners that investing time and energy into the FP&A process is worth it. Here is a tip to do just that.

The power of compounding in FP&A

Compound interest is one of those principles that can leave you speechless about how powerful it is. You don’t notice it at first, but consistently making a small step in the right direction makes a big difference. Here is how you can use it to your advantage when trying to master FP&A.

Popular planning approaches compared

The three most popular planning approaches are percentage adjustment, zero-based budgeting, and driver-based budgeting. Don’t make the mistake of using them in the wrong circumstances. That doesn't just hurt the accuracy of your plan, it can also have other adverse effects. Read on to learn more about when to use each one.

How to get started with FP&A Benchmarking

To understand how your business is doing and what needs to be improved, you should compare it to others like it. Otherwise, it’s too easy to think everything is fine when in fact, your competitors are leaving you behind. This is a brief guide to get you started with FP&A benchmarking.

How to get a seat at the decision table when you’re in Finance

Finance leaders don’t always have the chance to impact major company decisions. That happens when the finance team is seen as the department that only produces standard reports and cuts budgets. But FP&A leaders can and should have a seat at the decision table. In this article, I’m walking through six approaches you can start today to grow your influence.

What you need to unlearn to succeed in FP&A

A college degree in business, finance, or accounting is an excellent foundation for a career in FP&A. But traditional education comes with a significant downside. Going for perfect grades at work can set you up for failure. Here is why and what to do about it.

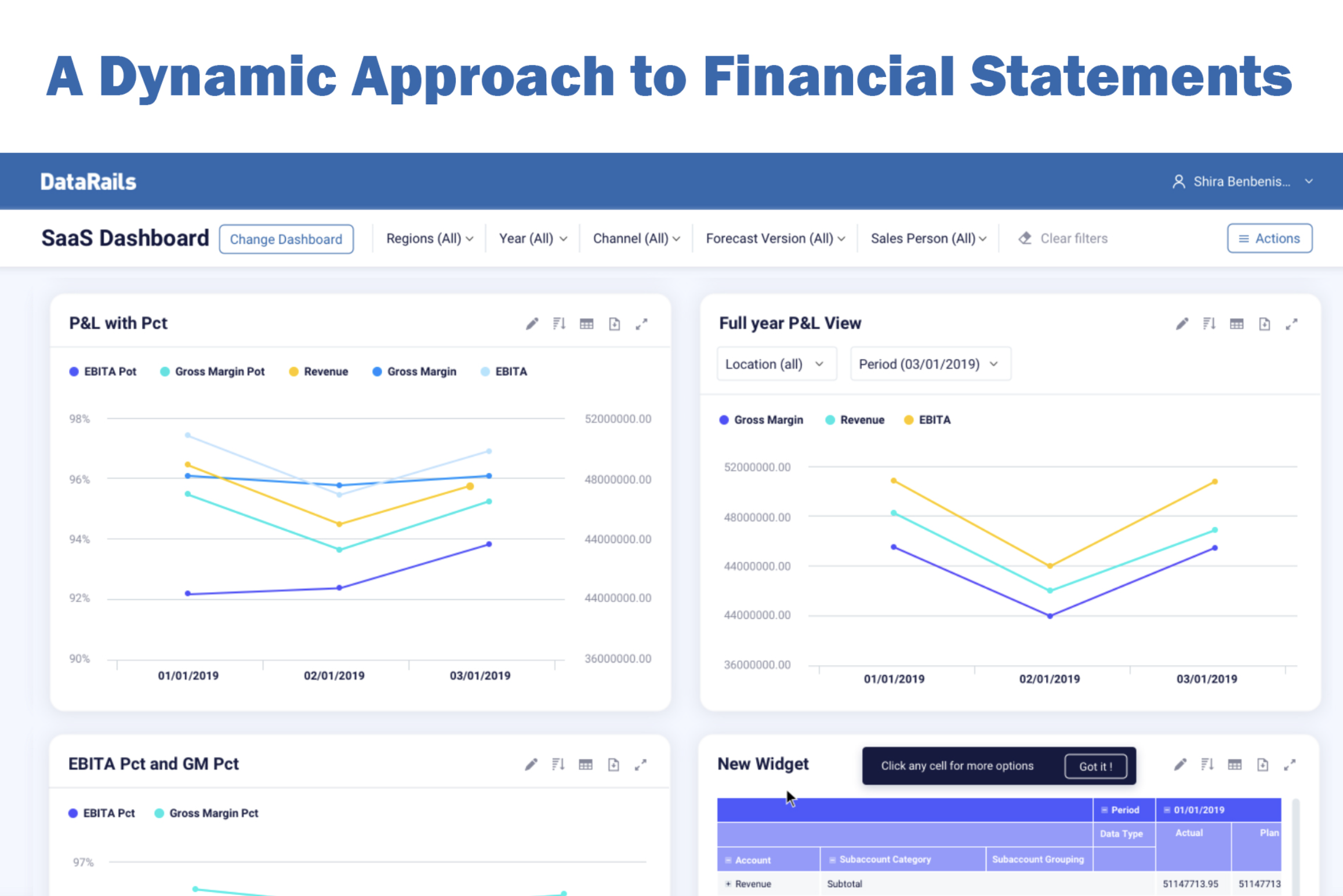

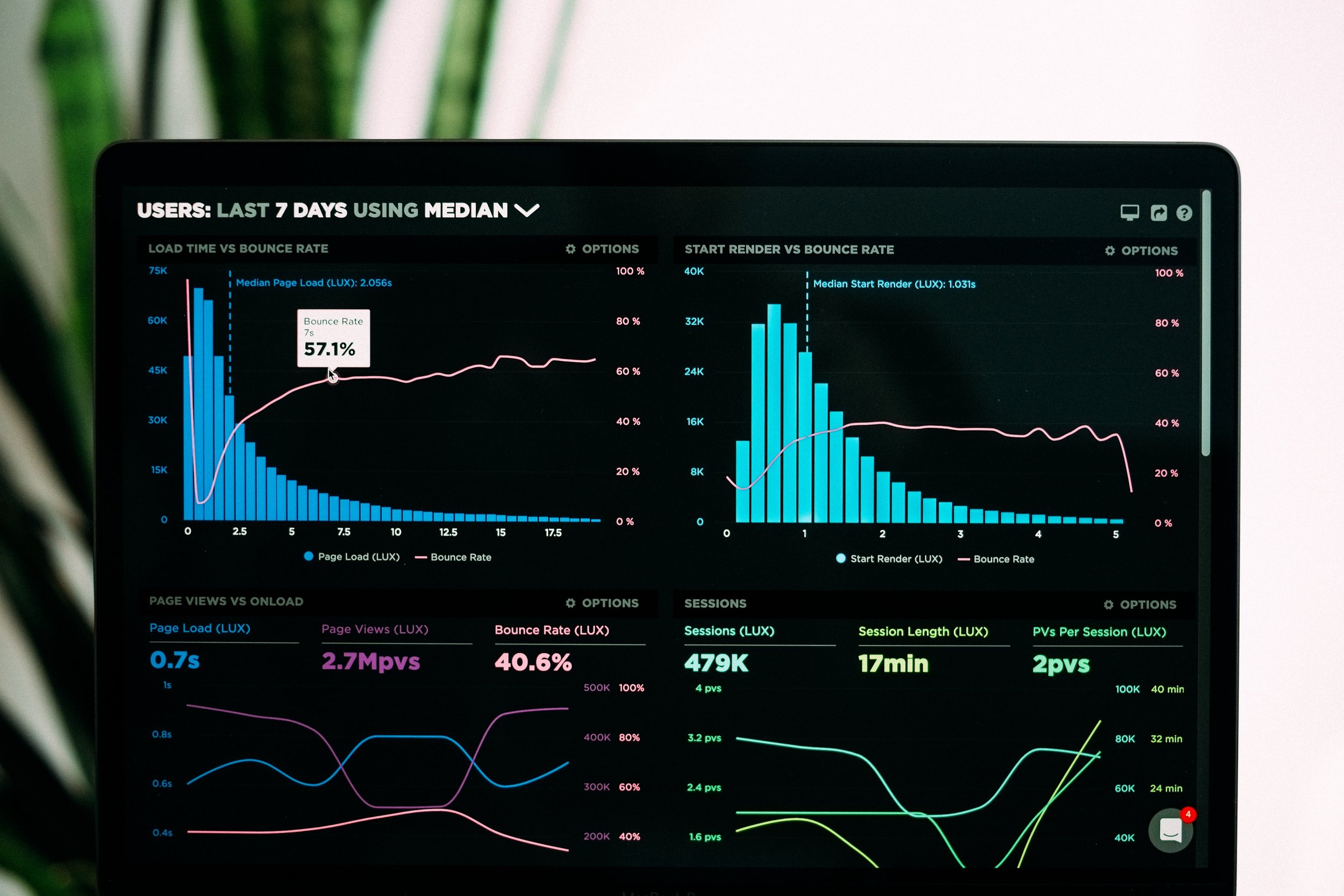

Why your FP&A Dashboards don’t work

FP&A dashboards show how your company is doing at a glance. They include the latest insights into what matters most to your company at this point in time. The job of the dashboard is to tell leaders when corrective action is necessary and which business driver to investigate. If it doesn’t, that’s a problem. Here is a brief overview of what may cause your dashboards to fail and what to do to fix them.

How to build business understanding as FP&A Manager

Without knowing the business inside and out, you can only do so much as FP&A Manager. Sure, you can create reports about the current performance of the business and attempt to forecast its future outlook. But to increase your value, you need to know more about the business model than where the revenue comes from.

You can only become a strategic advisor to the business if you understand how your cross-functional partners turn inputs into sales. Here is what I learned works best to build business understanding.

How FP&A Analysts challenge their business partners

Suggesting what other leaders should do is a part of every FP&A role. So, improving your influencing skills can easily 2X your impact. But if you overdo it or challenge them too directly, your relationships suffer. I summarized what my mentors taught me in three Dos and three Don’ts.

The 7 Excel habits of highly successful FP&A Analysts

There is more to mastering Excel than knowing how pivot tables work or using dynamic cell references. There are a number of habits you need to build to navigate massive spreadsheets and financial models with ease. I’d argue there are seven of them that stand out specifically.

My FP&A productivity approach

I made a lot of mistakes during my 12 years in FP&A. Many of them resulted in things taking longer than they should. But I learned from them. In this post, I share my productivity lessons covering a typical month in the life of an FP&A Analyst. We cover the Dos and Don’ts for Month-End Close, Management Reporting, Forecast Updates, and Financial Modeling.

The best FP&A Tool (in my opinion)

I finally made up my mind about which FP&A tool I like best. It automates reporting and gives you full database and ad-hoc analysis capabilities, all while being able to stay in Excel.

Less is more in FP&A

People think spending a few more hours each month on things like forecasting, variance analysis, or creating a financial package will surely pay out. But I argue that there are ways to save time that don’t sacrifice quality. And as a result, you can invest those extra hours into those activities that have the highest impact. In this short article, I summarize four ways how to do just that.

How to master Forecasting as an Accountant

As an Accountant, you know the ins and outs of reporting historical financial data and crafting perfect P&Ls, Balance Sheets, and Cash Flows statements.

But transitioning from focusing exclusively on looking at the past to creating forward-looking outlooks can be tough.

So, let me walk you through step-by-step, covering the 7 most important phases of creating a financial forecast.

We asked 200 CFOs: What do you expect from a well-performing FP&A function

FP&A is a crucial function within any finance team of a company that values growth and knowing where they are headed. But different CFOs may have different ideas about what that means exactly and as a result, their expectations about FP&A differ.

Datarails interviewed 200 CFOs about what they value most about FP&A. Read on to learn what it is and my suggestions about how you can put it into practice.

Financial Modeling - tips from my mentors at Unilever and P&G

The challenge with Financial Modeling is that it may take hours until you realize you are on the wrong path. You may suddenly realize that you chose the wrong model type. Or you see that you need inputs that are more detailed. Both realizations require that you (almost) start from scratch, which means you lose a lot of time and nerves. Here is what I learned from my mentors at P&G and Unilever to prevent that.

The five worst forecasting mistakes

Your forecasts are inaccurate? Or worse: People think it’s a waste of time? Then STOP making these five forecasting mistakes.

How to spend less time in meetings

Spending too much time in meetings is risky. That’s because it robs you of the opportunity to take a step back and look at your responsibilities from a different angle. At best, you lose out on out-of-the-box ideas. Worst case, you won’t get out of firefighting mode, because you lack the time to prevent fires from happening in the first place. Read on to learn 4 ways to spend less time stuck in meetings.

Seven Excel mistakes to avoid

I have used Microsoft Excel almost daily for the last 12 years. It’s the FP&A Manager’s most used tool. And despite its age (40 years!) I firmly believe it will stick around for many more years to come. It’s just too flexible and easy to use compared to competing solutions. So, there is no way around learning how to master it. Here are 7 mistakes to avoid.