What Accountants need to know to succeed in FP&A

Are you an accountant who is curious about FP&A? Or are you already working on transitioning into a Financial Planning & Analysis role? This article highlights the five skills you need to learn to succeed.

How implementing FP&A drives growth - and how to get started

If your company doesn’t do much FP&A yet, but you are ready to get started, this article is for you. Read on to learn how FP&A teams impact the top and bottom line of your company. Learn what common roadblocks are and how to overcome them.

The five types of FP&A roles

When you choose which kind of FP&A role to do next, you need to choose wisely. You need to be aware of what else is out there and how the roles differ. Some require little business partnering, while others rely on it completely. Some have almost daily exposure to senior leaders, while others do only rarely, if at all.

So, it’s important you understand what you are getting yourself into before you accept that shiny, new FP&A job.

These are the five major roles.

Scorecards that make a difference

Do you know the difference between dashboards and scorecards? They have different objectives. The former serves as a quick snapshot of how the company is doing. Dashboards cover a broad range of metrics and are only discussed if there is a big issue.

Scorecards on the other hand need to do more. They need to measure the company’s strategies and give a clear yes or no answer if they are working.

Creating scorecards that achieve that isn’t easy - so I summarized it in this brief post.

How to learn Excel - the easy way

Succeeding in Finance essentially means succeeding in Excel. But the road to true Excel mastery can be tough. The software’s best feature - its immense depth and flexibility with 435 different formulas - can seem daunting. But it doesn’t need to be hard to learn Excel if you follow the right approach. Read on to learn my two-step process to get there.

How to say “no” as FP&A Business Partner

Saying “no” at work is as essential as it is difficult. But, like so much else, it’s a skill that can be learned.

If you follow these four steps, you are well on your way to lightening up your workload.

How to save time when creating financial presentations

Don’t waste time spending hours every month preparing your financial presentations. There are a number of tricks you can use to save time - even without investing in a new tool.

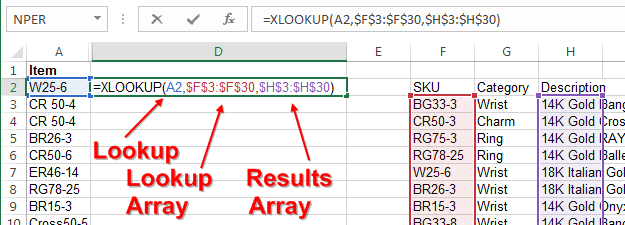

Excel fight: VLOOKUP vs XLOOKUP vs INDEX / MATCH

Choosing the right look-up formula can save you hours of work and, crucially: it can also save you from making avoidable mistakes. We reviewed the new Xlookup formula and checked how it compares against Vlookup and Index/Match.

Read on to find out who takes the crown for the best look-up formula in all of Excel land.

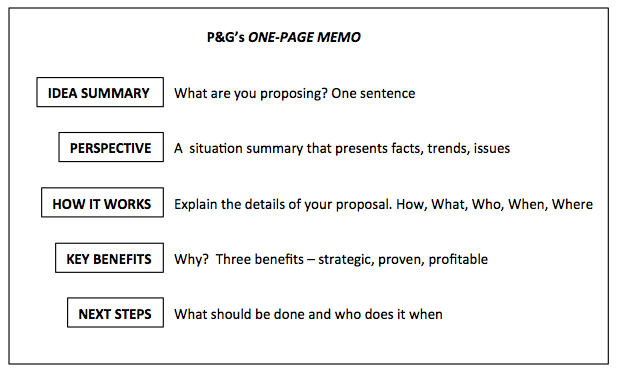

Why PowerPoint decks have no place in the future of FP&A

Here is how you can radically improve the efficiency of your decision meetings.

How FP&A Leaders drive company strategy

As FP&A leaders, we don’t always have the luxury to be able to simply tell someone what we would like to get done. Especially when it comes to company strategy, we often need to influence those over whom we don’t have hierarchical authority.

This 5 step guide aims to help you convince even the most confident of CEOs.

How to de-bias revenue forecasts

Most projections aren’t true “50/50” forecasts, meaning they don’t have an equal probability of being too high or too low. In other words, they are biased.

Here is how to de-bias them.

Are you using the 80/20 principle to its fullest?

The 80/20 principle, also known as the Pareto principle, says that it takes 20% of the effort to achieve 80% of the results. To get the remaining 20%, you’ll need to put in 80% of the resources.

Read on to learn 5 ways to apply it in your role.

Don't always prioritize urgent tasks - use this framework instead

Sometimes we feel like we rush from urgent task to urgent task but still feel like we didn’t accomplish anything meaningful at the end of the day. And we may start to think that we shouldn’t have to deal with the same kind of issue over and over again.

To get you out of this “busyness conundrum” I combined two prioritization frameworks to hopefully make your work life a bit easier to manage.

Why Excel will never go away

There is a hot debate among FP&A Experts about whether Excel should be replaced or if it’s here to stay. In this post, I’m making the case that Excel is here to stay, despite its old age of now 35 years.

And I’m sharing concrete advice on how you can make the most of Excel by addressing its shortcomings.

McKinsey’s advice on how to collaborate better and what FP&A teams can learn from it

“Analysis paralysis” can happen to anyone. Not even senior leaders are immune. Rather than getting stuck in a spreadsheet, they run from endless meeting to endless meeting without a clear decision at the end.

The culprit is often simply that roles and responsibilities aren’t clear or decision-making powers are shared too liberally. KcKinsey advocates for the use of the DARE framework to counteract these issues.

How to talk about emotions at work

Every leader needs to have difficult conversations at some point. Especially those with team members who struggle emotionally can be difficult to navigate. Leaders want to “keep it professional” but that tends to result in the other person feeling brushed off and ignored.

So, it’s helpful to have clear guidance on how to manage these difficult conversations. Read on for concrete examples of what you should or shouldn’t say based on work by Harvard Business Review.

How to level up your forecasts from good to great

You already compare bottom-up and top-down plans to optimize? Congratulations! But there is more you can do. In this post, I share actionable advice on how you can bring each of the two forecast types to the next level.

Why you need to have both: a top-down and a bottom-up forecast

If you only do one, you are not only losing out on accuracy. You are also robbing yourself of high-value conversations. In this short article, I summarize how to realize those benefits.

How to listen

Many see listening as the top leadership skill. To be a successful Finance Business Partner, it’s certainly essential. The reason many aren’t good listeners is that we aren’t taught the right techniques in school. This post introduces three ways to immediately become a better listener.

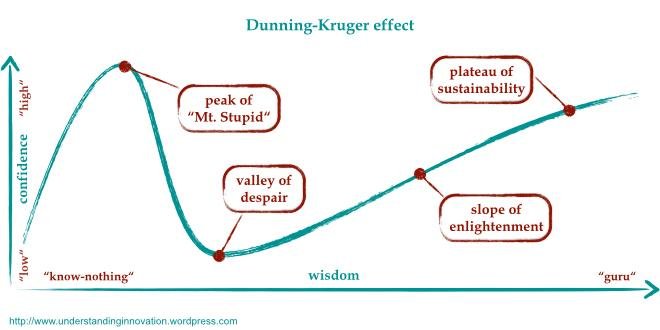

How three cognitive biases harm your decision making (and what to do to avoid them)

The narrative fallacy, confirmation bias, and the Dunning-Kruger effect are three common cognitive biases. If you don’t know how to deal with them, they can significantly harm your decision-making at work. This article introduces the concepts and provides simple ways to manage their impact.